The Benefits of Embedded Payments for Sports Management SaaS Providers

As coaches and sports team professionals seek ways to free up their administrative workload, the use of sports management software is burgeoning — and a growing number of SaaS providers are entering the playing field. In fact, the global sports management software market is forecasted to reach nearly $16 billion by 2027.

Amidst this lucrative industry growth, many SaaS providers are optimizing their sports management solutions by embedding payment processing features. With the introduction of integrated payment processing, sports leagues and camps can reap the benefits of streamlined fee collections and accounting — directly within their management system.

Understanding the unique payment needs and preferences of sports organizations is the first step for SaaS companies that want to successfully embed payment features. Keep reading this article for an overview of some of the typical payment processing dilemmas for sports organizations, and to learn how embedded payments can optimize operational performance.

Common Payment Collection Challenges Faced by Sports Organizations

Operating a successful sports organization hinges upon the collection of registration and membership fees. Yet all too often, collecting these fees turns into a time-consuming process of chasing down customers and making multiple trips to the bank to deposit checks and cash. On top of that, many sports organizations are overwhelmed by high processing fees and messy, time-consuming accounting processes.

Let’s take a closer look at some of these payment challenges.

Outdated Payment Acceptance Processes

Many sports organizations collect check or cash payments from customers instead of credit card or ACH payments. The challenge with traditional check and cash payments is that they must be collected and funded entirely manually. Sports team administrators have to take the time to collect payments from customers either in person or via snail mail, and then deposit the payments in their bank account. This process only becomes more tedious when it comes to repeat payment plans, such as memberships and payment installments — both of which are very common in the sports club world.

Complicated Account Reconciliations

When payments are collected manually, it becomes more difficult to maintain accurate and up-to-date financial records. Cash and check payments have to be tediously entered into the accounting system and tallied up with accuracy. Should an error be found during account reconciliations, it can be difficult to resolve since checks and cash don’t leave behind a good paper trail.

Refunds and payment disputes are also more cumbersome for cash and check payments. Rather than simply returning funds to the customer’s card, a staff member needs to take the extra time and expenses to issue and mail a check — or, they need to track down the customer to hand them cash.

High Processing Fees

Many sports teams are small neighborhood organizations that don’t have large operating budgets. For this reason, sports teams and clubs often struggle with the cost of credit card processing — or they may choose to forego credit card processing altogether, incurring the above challenges instead.

The reality is that many leading payment processing companies charge inflated flat-rate processing costs that are unsustainable for smaller businesses. Yet as we will soon discuss, there are ways for businesses to secure lower payment processing rates — and as a SaaS provider, it’s important to be able to bring clients the lowest costs possible.

The Advantages of Embedded Payments for Sports Organizations

Embedding payment processing technology into sports management platforms brings incredible value to users. With the ability to process and manage payments in one central location, administrative tasks are greatly reduced and simplified. Users can receive payments, manage their budgets, and monitor repeat payment plans with greater ease.

Here are some of the biggest benefits experienced by sports teams that use embedded payment features:

Automated Payment Acceptance

Electronic payment processing eliminates many of the manual tasks associated with cash and check payment acceptance. Users of sports management software with embedded payments can easily send out payable invoice links, set up recurring payment plans, and process one-time credit card or ACH payments. No more need to chase down customers or wait for them to send in paper checks.

Simplified Account Reconciliations

When payments are handled electronically, bookkeeping becomes that much easier. Embedded payment solutions sync payment acceptance with account receivables, so that staff no longer need to manually enter incoming payments. Every time a payment is made via an embedded processing system, it’s updated automatically within the sports team’s management software — giving them visibility into real-time cash flow and eliminating the need for cumbersome manual reconciliations.

Seamless Recurring Payments

Many sports organizations offer memberships as well as payment installment plans for customers that want to break a larger payment into multiple payments. In these instances, collecting payments via cash or check is not only time-consuming but also likely to result in late or missed payments.

Electronic recurring payments can fully automate this ongoing collection process — resulting in improved customer satisfaction, reduced member churn, and fewer missed payments. Many embedded payment solutions enable users to create recurring payment plans using securely-stored card or ACH information, with the desired payment frequency and amount. Rather than having to reach out to customers every time a payment is due, sports teams only need to collect payment details once — and the rest is automated. Besides offering greater convenience and customer satisfaction, recurring payment systems are also highly beneficial for cash flow management.

Competitive Processing Rates

Big-name payment processors like Stripe and PayPal are popular choices among sports organizations. Yet while their flat-rate fee models are transparent and easy to understand, they are certainly not the most cost-effective. There are a wide range of payment gateways and payment processors on the market, some of which have highly competitive rates for the sports industry. This means that sports management SaaS providers have the flexibility to choose a more competitively-priced embedded payment solution that their customers will prefer.

Data Security and Compliance

Any organization that stores and transmits payment data is responsible to maintain compliance with the Payment Card Industry’s Data Security Standards (PCI DSS). Compliance with PCI DSS can be complex, especially so for organizations that rely on manual processes, spreadsheets, and extensive paperwork to gather and track payment information. With an embedded payment solution, sports teams can benefit from end-to-end PCI compliance — greatly reducing the compliance burden.

Power Up Your Sports Management Software With Embedded Payments

As the number of sports management software companies increases, now’s the time for industry players to establish a competitive edge. By embedding powerful payment processing technology, SaaS companies can provide users with powerful, time-saving features — all while earning a portion of the fees charged on transactions.

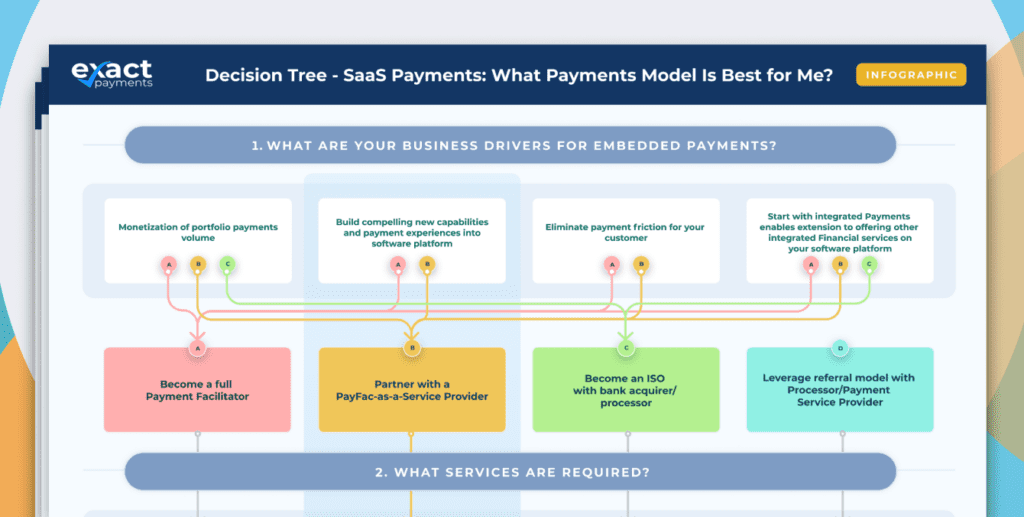

Want to learn more about how you can get started with embedded payments? Be sure to read our white paper, “How to Choose an Integrated Payment Model for Your Software Platform.”