The PayFac Profile: Examples of Successful Payment Facilitator Companies

By leveraging payment monetization and user experience best practices, the payment facilitator model offers a versatile approach to revenue growth — one that benefits businesses of all kinds. Payment facilitator companies are able to provide their merchants with built-in payment processing capabilities and earn a portion of all transaction processing fees.

From established franchises to budding startups, and online marketplaces to subscription-based services, the PayFac model has proven its adaptability in a way that transcends industry boundaries and business sizes.

Yet even though the PayFac model has been adopted by businesses in a wide range of industries, there are common characteristics that unite the diverse array of payment facilitator companies. In this article, we’ll delve into these characteristics and provide some examples of PayFac companies.

With a clearer picture of who stands to benefit most from the PayFac model, you’ll have a better idea of whether payment facilitation is right for your company. Let’s get started!

The Growth of Payment Monetization

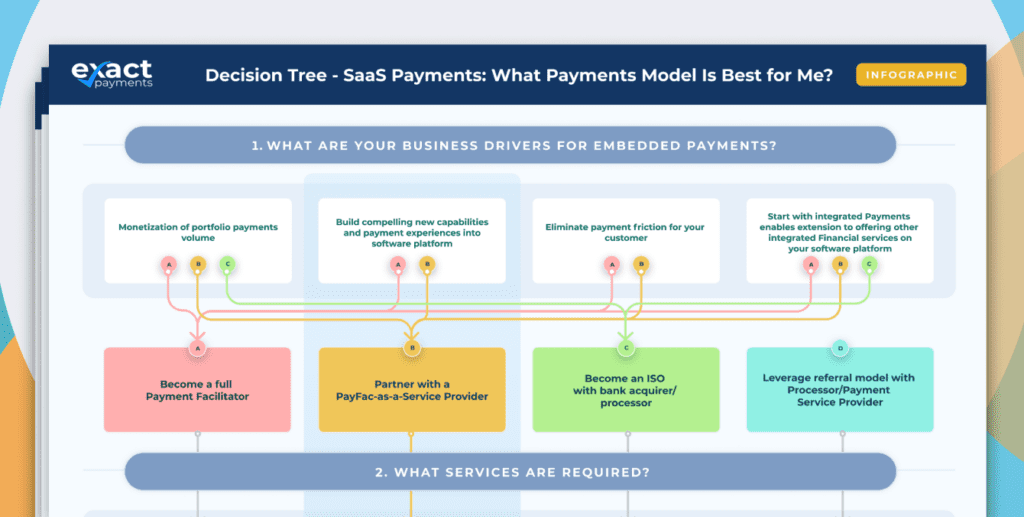

If you’re exploring the PayFac model for your business, chances are high that you’re looking to add a revenue stream. Particularly among SaaS businesses — most of whom are aiming to grow expansion revenue and net dollar retention — payment monetization has become a desirable business strategy. This strategy entails tapping into the lucrative payment market and earning a portion of payment processing fees.

The PayFac model has made it easier and more customer-friendly for businesses to monetize payments. In contrast to other payment monetization strategies, becoming a PayFac brings with it sky-high revenue-earning potential and incredibly innovative embedded features. With this in mind, it’s no wonder that the number of payment facilitators globally is expected to top an incredible $4 trillion annually by the year 2025.

Common Types of Payment Facilitator Companies

Among the thousands of companies that are operating as PayFacs, several industries have reaped incredible success. In recent years, the PayFac model has generated a lot of traction with the following types of businesses:

1. Franchises

The PayFac model is a great option for franchise businesses with multiple locations — such as fitness centers, healthcare providers, and restaurants. Each location can be onboarded as an individual sub-merchant under the PayFac’s master merchant account. This greatly streamlines financial operations and offers a consistent user experience across all franchise outlets.

2. SaaS Companies and ISVs

Software-as-a-service providers and independent software vendors (ISVs) make up the bulk of today’s PayFacs. As of 2020, an astounding 41% of all payment facilitator companies were ISVs.

These types of companies already sell software — typically on a subscription basis — which means they have a solid customer base to whom they can easily upsell add-on payment features. Additionally, integrating payment technology is a smart move to improve the overall customer experience. It gives end users the ability to seamlessly make payments from the convenience of the app or software they already know and love.

The PayFac model has been successfully adopted by SaaS companies in a range of verticals. See the below section for some examples and use cases.

3. Online Marketplaces

The third major category of businesses that are becoming PayFacs is online marketplaces. Online marketplaces like Amazon and eBay are e-commerce platforms that sell goods and/or services from a wide range of third-party vendors. The PayFac model is ideal for online marketplaces because each third-party vendor can be registered under the PayFac’s main payment processing account.

Categories of PayFac Software Companies

There are many different types of industry-specific software platforms that have harnessed the PayFac model. Let’s take a look at some top industries and brands:

| Software Category | Use Case – PayFac Examples |

| Online shopping carts | For the many online merchants who use e-commerce platforms to sell their products, integrated payment processing is a desirable feature for its ability to sync payment activity with overall storefront management. E-commerce platforms like Shopify have amassed incredible success — and profits — by operating as payment facilitator companies. According to Bain and Company, Shopify generated over two-thirds of its 2021 total revenue ($3 billion) from credit card processing and currency conversion fees! |

| Accounting and recurring billing software | Integrating payments within accounting or recurring billing software is a smart move that directly caters to user preferences. Users can reconcile accounts and collect invoices all in one place — improving cash flow while saving time and hassle. Leading accounting software brands like Intuit and Sage have embraced the PayFac model to offer their customers built-in payment processing features. |

| Gig economy platforms | A growing number of platforms like Instacart, Fiverr, and TaskRabbit facilitate freelance and temporary job hiring. These platforms are well-suited to the PayFac model, as they simplify payouts to employees while embedding payment functionality that employees and customers alike can utilize. |

| Cloud-based POS systems | Toast is an example of a POS system provider that has perfected the integrated payment approach. Restaurants that use their advanced point-of-sale solution can get set up swiftly with payment processing accounts and provide frictionless checkout experiences to diners. Not only did Toast improve the customer experience, but they’ve also exponentially grown their profits as a result. According to Bain & Co, about 80% of Toast’s revenue is from payments or other financial services. |

| Health and wellness apps | For health and wellness apps that enable customers to buy classes or memberships, integrated payments can greatly improve the checkout process. Customers can choose their desired class and buy a membership, subscription, or package all in one place. Fitness app MindBody is one of the best examples of payfacs, operating as a health app. Mindbody is able to easily manage payouts to the many fitness companies that sell classes on its app, while also making it easy for fitness club patrons to pay. |

5 Key Characteristics of Successful PayFacs

If your business doesn’t fall under one of the above categories, that doesn’t mean the PayFac model won’t work for you. There are so many different use cases for payment facilitation, it’s just not possible to include them all in one article.

As an aspiring PayFac, it’s more important to focus on your business’s unique profile. It’s not just your industry, but your customer base, business model, and budget — among other factors — that predict your success as a PayFac.

Here are some common traits shared by successful payment facilitator companies. If your business has most or all of these, becoming a PayFac could very likely be a good move!

1. High Transaction Volume

Operating as a payment facilitator can incur a lot of overhead costs — particularly if you’ve chosen to build the entire PayFac infrastructure in-house. In order for payment facilitation to be profitable for your company, you need to have a merchant portfolio that’s processing a sizable amount of transactions. If you have a small merchant base, or your merchants’ customers aren’t making frequent or high-ticket transactions, then you may end up spending more than you earn.

2. High Budget and Resources

Businesses that become payment facilitators can expect to pay upwards of two million dollars upfront — in addition to over $500K in ongoing maintenance costs. For this reason, many companies choose to become PayFacs only once they have backing from private equity companies.

However, if your budget is the only thing holding you back from becoming a PayFac, keep in mind that there are more affordable options on the market. For example, PayFac-as-a-Service providers like Exact Payments equip businesses with out-of-box PayFac tools — at a fraction of the cost of building all these tools from scratch.

3. A Passion for Optimizing the User Experience

Payment facilitator companies can embed cutting-edge payment features within their software platforms, which enables them to create a much more seamless and branded payment journey. This embedded experience eliminates the need for redirects to third-party gateways or systems, and grants more control over the entire payment flow.

4. A Desire to Simplify Onboarding

Many software companies that have referred clients to third-party payment processors have witnessed firsthand the tedious onboarding process. To open a traditional payment processing account with an acquiring bank, merchants have to fill out extensive paperwork and wait several days or weeks to get approved. By becoming a PayFac, software companies can offer merchants a faster and easier online onboarding process. Merchants only have to submit a few key data points to get approved — typically with approvals granted in less than a day.

5. Rapid Growth

Is your business scaling up fast? The payment facilitator model makes it much quicker and easier to onboard merchants with payment processing accounts. If you’re already offering integrated payments through a referral partnership, for example, then it may be time to switch to the PayFac model for its incredible scalability.

Partner With Exact Payments to Speed Up Your Path to PayFac

Is your company ready to reap the benefits of the PayFac model? The future of payment facilitators is software companies like yours. With Exact Payments, you can harness the PayFac model in less time and with less overhead costs. Our advanced APIs make it easy to embed payment features — so you can start earning a cut of processing fees and leveling up the customer experience that much faster. Contact us today to learn more!