What Is Network Tokenization And Why Is It The Future Of Secure Digital Commerce?

In today’s digital world, sellers have a broad range of technologies and services available to help them build a fully secure and reliable payment experience. One of the most powerful tools available is credit card tokenization, which allows sellers to store algorithmically generated, encrypted values in place of full credit card numbers. As a result, these payment tokens cannot be used by fraudsters in the event of data loss or breach. Tokenization also helps reduce the PCI compliance scope that merchants must deal with. The technology behind tokenization is essential to many of the ways businesses buy and sell today. But tokenization isn’t just a security technology — it’s a means for creating a smoother payment experience and more satisfied customers.

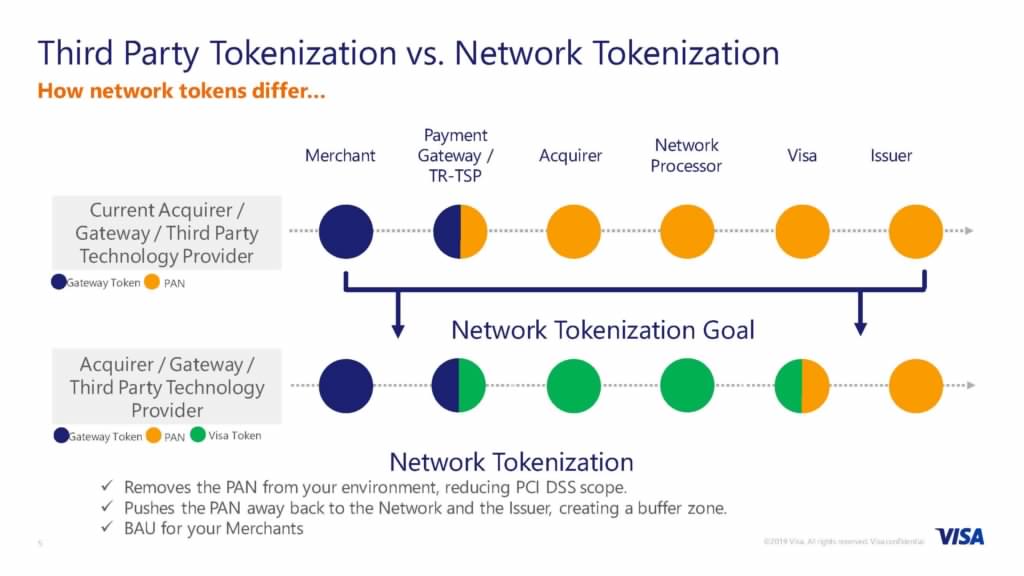

While tokenization is not a new concept, there are many options and implementation paths to evaluate before making a choice and rolling out what should become a cornerstone of your digital security strategy. To start, it is important to understand the three (3) tokenization models offered in the market today — (i) gateway tokenization; (ii) processor tokenization and (iii) network tokenization.

Let’s look at each model and then dive in greater detail to the trends and benefits of network tokenization. Spoiler alert—we believe network tokenization is the optimal payment transaction solution for most businesses today and for the long-term.

GATEWAY TOKENS

Gateway tokenization is a service offered by most payment gateway platforms including Exact Payments. In the seller’s integration with its gateway provider, various interfaces route the actual credit card number to the gateway where it is tokenized and stored. The token may also be returned to the seller in the response message. The seller can then store the token for recurring billing or future purchases by customers. Gateway tokenization algorithms are typically proprietary and can not be used with any other gateway, processor or payment platform. As a result, if a seller decides to switch payment gateways, they may be faced with the tedious process of requesting that their current gateway provider ‘de-tokenize’ and securely transfer the resulting file of credit card #s to another, new gateway provider who, in turn, will re-tokenize and store the records using its own proprietary token algorithm.

PROCESSOR TOKENS

Processor tokenization is quite similar to gateway tokenization in that both utilize proprietary algorithms which are not portable to other processors, gateways or payment platforms. The key difference is around where credit card tokenization is performed. With processor tokenization, the card # comes in from the seller to the payment gateway and is then passed to the processor’s platform where it is tokenized. The token is then returned via the gateway to the seller. Again the gateway and seller may store the token for future use. Note: gateway/processor integration models may vary. The most common integration path is the one described here— seller/merchant < > gateway < > processor.

WHY CONSIDER MOVING TO NETWORK TOKENS

There is a lot of excitement and momentum in the industry around the distinct benefits sellers realize when using Network Tokenization to process payments and secure cardholder data. What immediately grabs your attention is the new data being promoted by Visa and others, citing up to a 3.2% increase in authorization approval rate for eCommerce transactions when using Network Tokens.

Imagine going to your CEO to report, “I have a way we can increase eCommerce sales by 3.2% without any new product, additional marketing expense or blowout sale promotion.” That would be a fun, ‘career enhancing’ conversation.

INCREASED SALES WITH NETWORK TOKENS

How do Network Tokens generate increased approvals on credit and debit card transactions? One word… ‘trust’. Network Tokens are created and ‘issued’ by the bank’s system (via the Visa or Mastercard network) rather than an external party as is the case with gateway or processor tokens. This means that the bank establishes the relationship between the token and the underlying cardholder account and can track all activity across the lifecycle of that token. For example, the bank’s systems track each device using a network token and associate it back to use of that same device in other transactions or interactions with a cardholder (ex. customer uses the bank’s mobile app from her smartphone).

According to Visa, “richer data carried with the token (e.g. device info) enables better decisioning by the bank including for card-on-file transactions. The inherent trust between the card issuing bank, a Network Token, the device and the seller adds up to one powerful benefit— increased sales and fewer nuisance declines.

SMOOTHER PAYMENT EXPERIENCES

Network Tokenization creates a smoother checkout process by managing the entire lifecycle of a token and associating it with other data maintained by the bank. One powerful advantage for sellers is the ability to receive automatically updated card details, including expiration dates, when submitting a transaction for authorization. This process is referred to as Card Account Updater. CAU saves subscription companies and eCommerce sellers from nuisance declines caused by having expired card details on file. Sellers benefit from an increase in authorization approvals as well as a huge time saver for their finance and billing team. No more attempting to contact cardholders to request updated card information on declined transactions. Cardholders love the seamless experience… they continue enjoying your service… no emails, phone calls or logging into a portal to update card information.

REDUCED FRAUD EXPOSURE

The end-to-end security journey that Network Tokenization offers greatly reduces the risk of losing valuable card data due to malware, phishing attacks and data breaches. In other words, tokenized card data is rendered useless if stolen. The resulting reduction in fraud translates into benefits for everyone—increased sales, lower losses, fewer cards reissued, and improved customer buying experiences.

In fact,Visa is reporting that Network Tokenization reduces fraud rates by as much as 26 percent! That is thousands of dollars (or even $ millions) to the bottom line of most sellers.

INTERCHANGE INCENTIVE FOR SELLERS

Most recently, Visa has introduced incentive rates on ecommerce transactions processed with Network Tokens. Specifically, the rate when using Network Tokens is 10 bps lower for most ecommerce transactions. Visa is creating a valuable incentive for sellers to integrate Network Tokens in order to improve authorizations and increase security across the payments journey. We are watching closely to see if the other card networks follow suit.

Your customers expect fast, frictionless payment experiences. When expectations aren’t met, your Company loses sales and leaves the customer questioning whether to purchase from you in the future. While Network Tokenization is still a relatively new service in the market, momentum is building fast. Now is a perfect time for you to start exploring the full range of benefits available to your Company.

In our next Blog article, we will dive into the various options for migrating from gateway or processor tokenization to Network Tokens. If you can’t wait and would like to explore options today, click here to speak with one of our Solution Consultants.

Visit ExactPay.com for more information.